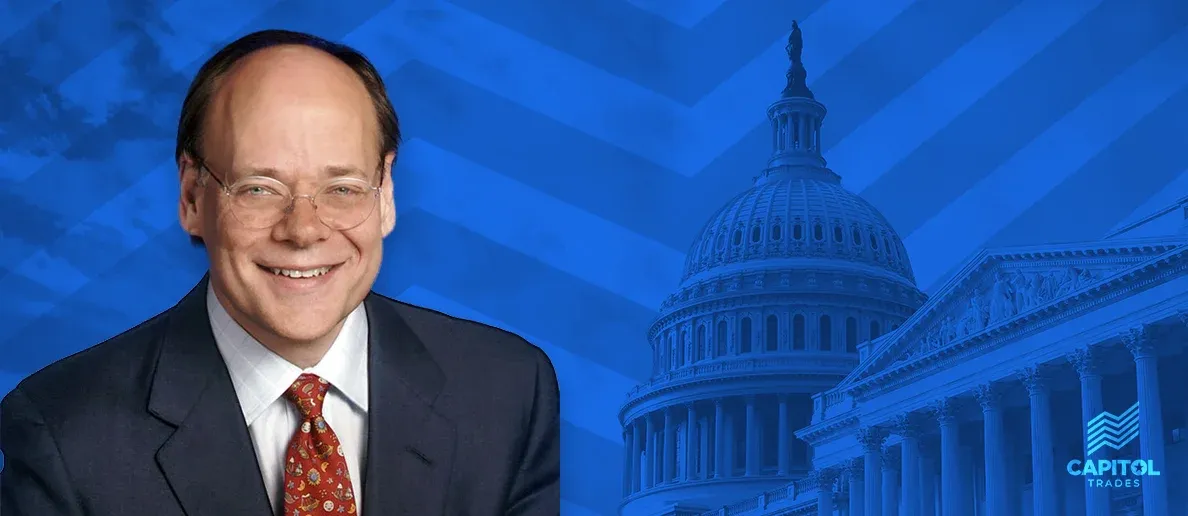

Congressman Cohen Continues to Buy Stocks

Steve Cohen, an American attorney who is serving as the U.S. representative from Tennessee's 9th congressional district since 2007, has continued to increase his exposure to the U.S. stock market.

Cohen has invested in the Schwab US Dividend Equity ETF, designed to measure the performance of high dividend-yielding stocks that constantly pay dividends. The size of the trade is set at between $50,000 and $100,000 and was made on July 29. This investment vehicle has modestly grown in valuation since Cohen made the investment two weeks ago.

Prior to Cohen, two fellow Democrats Hakeem Jeffries and Mikie Sherrill both invested in the same ETF earlier this year.

Earlier this month, Cohen disclosed that he bought a $15,000-$50,000 stake in the Tennessee-based First Horizon Bank on July 27. Shares of this financial company rose over 2% since the trade was made.

The ETF investment is only the fifth trade that Steve Cohen made this year. Aside from the First Horizon trade, Cohen also invested $50,000-$100,000 each in the Invesco Variable Rate Preferred and the Global X Variable Rate Preferred ETF.

Moreover, the Congressman also backed the First Trust Preferred Securities and Income ETF in February.

His activity this year comes after Cohen made only one trade in 2021 when he invested between $50,000 and $100,000 in the First Trust Preferred Securities and Income ETF. His prior investing activity in 2020 was tied to reducing market exposure given the outbreak of the COVID-19 pandemic.

Cohen sits in the Committees that are in charge of Natural Resources, Judiciary, and Transportation & Infrastructure.